[参考资料]:20步评估一项专利价值

发布时间:2010.12.04 北京市查看:21254 评论:42

20 Steps for Pricing a Patent

To value an invention you have to understand it.

By J. Timothy Cromley

November 2004

nventors help solve vexing problems, both sophisticated and simple, and as a result sometimes enjoy considerable celebrity and rewards. Our society’s economic success, too, is based on innovation. To encourage public disclosure of inventions, the U.S. Patent and Trademark Office (USPTO) issues an inventor a patent, which excludes others from making, using, selling or importing that invention into U.S. territories for a limited period of time. The three kinds of U.S. patents cover living plants, ornamental designs and useful inventions (the latter are called “utility” patents). Familiar products once protected by U.S. utility patents include Alexander Graham Bell’s “improvement in telegraphy” (the telephone), the Wright brothers’ “flying machine” and Thomas Edison’s “incandescent lamp” (the light bulb). This article provides valuators such as CPA/ABVs with a set of basic procedures for valuing U.S. utility patents.

Patents are intellectual property (IP) that may need to be appraised for accounting, tax, litigation and transactional purposes in situations that include divorce or bankruptcy actions, estate settlements, sales of businesses and company mergers (which might require valuing portfolios of inventions). The ability to appraise patents can be important for GAAP financial reporting purposes under FASB nos. 141 and 142, especially for auditors and valuators in high-tech industries in which there are lots of busine****ombinations. An understanding of how to appraise patents also may be useful in expert witness engagements (see “ Damages Aren’t Always Patently Obvious ”).

Edison and Beyond

U.S. patents are being issued at a rate of more than one million a decade.

Source: www.uspto.gov .

RESEARCH AND COMPARE

Some patents are very valuable, while many are not. Because patents often are quite complex, appraising one usually is a highly detailed and expensive process that requires the input of lawyers and advisers with specific technical knowledge and experience. The makeup of valuation teams will vary by engagement, but it is axiomatic that before an appraiser can value something, he or she has to understand what it is. Here are 20 steps to help valuators such as CPA/ABVs do that:

1. Check whether the patent is in force. Before the CPA/ABV starts a detailed evaluation, he or she should see whether one is warranted. The first question to ask is whether the patent’s maintenance fees are up to date. If not, the patent may be worthless. Maintenance fees are due at the U.S. Patent and Trademark Office at 3 12 , 7 12 and 11 12 years from issuance. Some payment delays can be rectified, but if the maintenance fees haven’t been paid by the “cure” date, the patent might be worth nothing due to “abandonment.”

2. Identify the context. The premise of any valuation engagement can affect its conclusion. For example, a patent royalty amount that seems reasonable in an arm’s-length negotiation may not be indicative of what later might be assessed for infringement of the invention if a plaintiff successfully sues for damages.

3. Gather information. For particularly valuable patents, CPA/ABVs should request the following:

A copy of the application file on the patent, including all USPTO correspondence.

A list of any foreign patent applications relating to the invention (and related sales).

Copies of any relevant business plan, marketing study, financial statements and independent appraisal.

Descriptions of any litigation, past or present.

Copies of any contract, licensing agreement or offer to license pertaining to the patent.

Available economic data on the industry in which the invention is used.

Copies of promotions and advertising materials used during the past year relating to the invention or the product in which it is incorporated.

Cost information relating to the existing or proposed patented product including cost accounting records and/or engineering feasibility studies.

4. Assemble a valuation team. Expertise in patent law, an understanding of monopolies, business valuation skills and a background in the technology of the patent are often essential for accurate patent valuations. Valuation teams ideally should include a patent attorney and someone with proven skills in patent economics such as a CPA/ABV who has testified on patent damages and is knowledgeable about the issue’s seminal case law.

5. Read the patent. The CPA/ABV should either carefully read the patent or carefully interview an independent patent attorney who has. Among other things, the patent includes the title of the invention, a serial number, the name

of the inventor

of the inventor and, if applicable, the assignee to whom the inventor

and, if applicable, the assignee to whom the inventor transferred ownership. The “claims” section of the patent presents the most important information: the scope of the invention. The background section often conveys the most useful information about the patent’s economic potential but is not legally binding. The “detailed description” section can be technical and lengthy; it expresses the physical aspects of the invention (a legal requirement) to those working in the relevant discipline. Unless used to define the claims, the description typically does not limit the scope of the invention and thus does not affect its value. The date of the patent lets the CPA/ABV calculate the patent’s remaining life. The “references cited” and “other references” sections provide a list of pertinent U.S. and foreign patent documents and may give insight into the patent’s technological niche.

transferred ownership. The “claims” section of the patent presents the most important information: the scope of the invention. The background section often conveys the most useful information about the patent’s economic potential but is not legally binding. The “detailed description” section can be technical and lengthy; it expresses the physical aspects of the invention (a legal requirement) to those working in the relevant discipline. Unless used to define the claims, the description typically does not limit the scope of the invention and thus does not affect its value. The date of the patent lets the CPA/ABV calculate the patent’s remaining life. The “references cited” and “other references” sections provide a list of pertinent U.S. and foreign patent documents and may give insight into the patent’s technological niche.6. Investigate the patent’****ope. A patent’****ope of protection often is the most important basis of value. A patent’s claims are analogous to real estate property lines. The CPA/ABV should pay careful attention to the claims section to understand a patent’****ope and how its claims relate to the marketplace and should discuss it with the patent attorney on the team. To better understand it, the CPA/ABV should analyze the “cited,” “related” and “citing” patents—including derivative inventions—and the extent to which patent holders had limited the scope of their patent because of arguments made to the USPTO in obtaining the patent.

7. Talk with a patent attorney. The CPA/ABV can go to the patent and patent attorney databases at www.uspto.gov to find the originating attorney

for the patent. A valuator will need the patent holder’s consent to discuss details not in the public domain. Legal factors that affect the patent’s value are whether there has been litigation and, if so, what the outcome was; whether foreign patent protection exists; and how likely it is that the patent might be declared invalid, infringed or infringing.

for the patent. A valuator will need the patent holder’s consent to discuss details not in the public domain. Legal factors that affect the patent’s value are whether there has been litigation and, if so, what the outcome was; whether foreign patent protection exists; and how likely it is that the patent might be declared invalid, infringed or infringing.8. Inquire about the patent’s validity. The possibility a patent may be held invalid if challenged in court diminishes its value. If it is discovered after a patent has been issued that the inventors didn’t meet the statutory requirements for obtaining it—for example, if they weren’t the inventors (35 USC section 102

), or had published information about the invention or offered it for sale more than one year before the date of application (35 USC section 102

), or had published information about the invention or offered it for sale more than one year before the date of application (35 USC section 102 )—the patent is invalid and substantially worthless.

)—the patent is invalid and substantially worthless.9. Inquire into blocking patents. Owning a patent does not guarantee the right to “practice the invention” if doing so infringes someone else’s underlying patent. If the new invention infringes a prior patent, the earlier one is said to “block” it, diminishing its potential value. A patent attorney familiar with the patent should research how likely it is that implementation of the patent will infringe another’s patent.

10. Consider synergies among patents. A portfolio of related patents can be worth more to a single owner than the same patents would be individually to multiple parties because it can eliminate blocking patents. With such portfolios it may be to the client’s advantage to value the patents as a family rather than individually.

11. Investigate foreign patent protection. Because patents are enforceable only within the jurisdictions issuing them, valuable inventions often are patented in several countries at once. A valid patent registered in multiple national jurisdictions will have a larger market and will be worth more. If the client didn’t consider the invention valuable enough to register in multiple national jurisdictions, the CPA/ABV should find out why.

12. Consider the remaining life of the patent. For valuation, CPA/ABVs must consider not only the legal life of the patent but also its economic, technological and regulatory context. In the United States, the legal life of a utility patent applied for after June 7, 1995, ends 20 years after its earliest effective filing date (35 USC section 154). Under transitional provisions, the term of any patent in force or pending on June 7, 1995, is the longer of 17 years from the date of issue or 20 years from the filing date. Previously, patents were granted for a term of 17 years from the date of issue.

A patent’s term can be extended up to five years if issuance was delayed by premarket regulatory review or to compensate for certain USPTO procedural delays in processing the application. A patent’s economic life can be considerably shortened by developments that make the invention obsolete.

13. Analyze any prior royalties paid for the patent. To develop a value for a patent as of a certain date, the CPA/ABV should note any prior royalties paid for the patent and look for differences in context from the previous to current time and analyze and explain them. The often cited patent infringement case Georgia-Pacific Corp. v. United States Plywood Corp. (318 FSupp 1116 (SD NY 1970)) lists 15 factors useful in analyzing royalties, among which are factor 5, the commercial relationship between the licensor and licensee, and factor 13, the realizable profit that should be credited to the invention (see “ Guidelines from Georgia-Pacific ”). Other factors may affect royalties, too. They include the remaining costs and risks of prototype development, whether the licensee or the licensor is to bear them and whether the licensee or the licensor is likely to benefit from or to be burdened by related patent litigation.

14. Inquire into any actual or threatened litigation involving the patent. The fact that a patent has been successfully litigated is evidence its owners believe it to be valuable and signals competitors to stay out of the market. This in turn helps to increase its value. The opposite also is true—a failed attempt to enforce a patent can adversely affect its value.

15. Identify the next-best alternative technologies. Identifying such technologies can help CPA/ABVs forecast the cost savings and/or price premium that can accrue to a client’s patent. For example, if research shows the next-best alternative technology depresses profit margins by 1% (other factors being equal), a royalty rate up to that percentage might be reasonable. Analyzing competing technologies helps demonstrate the invention’s potential to take market share and revenues away from the competition.

16. Estimate a demand curve for the patented item. Demand for a patented product, which often is a key concept in lost-profits damages analysis, is no less so in a patent valuation. The CPA/ABV should estimate the demand curve by reviewing the industry in which the patent and alternative technologies compete. He or she should talk to knowledgeable marketing professionals, search the Internet and conduct a market survey. The key question is “What is the expected level of revenues at various price points?”

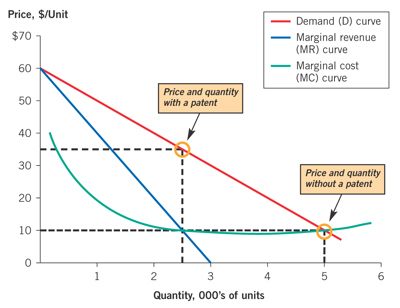

17. Determine the patented product’s point of profit maximization. CPA/ABVs can determine the unit price for profit maximization as follows: First, calculate a marginal revenue (MR) curve directly from the demand curve (D) determined by your research. (D curves almost always slope downward because as unit price declines, buyers are more apt to purchase or “demand” more units. MR curves, which depict the change in total revenue generated by the sale of one additional unit at various unit prices, similarly decline, but at twice the rate of their related D curves.)

Second, develop preliminary cost estimates at various levels of production, and from them derive a marginal cost (MC) curve. MC information sometimes can be gathered from cost accounting information and/or from engineering feasibility studies.

Third, if both MR and MC curves can be determined for a patent, it’s possible to show the price at which certain quantities are likely to be sold. For example, the profit-maximizing price with a patent is shown by the point on the D curve directly above the intersection point of the MR and MC curves. Thus, with a patent, ABC Corp. might be able to sell 2,500 widgets at $35 each (see exhibit ). Without a patent, however, competitive pressures will push the price down to $10 a widget (where the D and MC curves intersect)—but at that low price total demand will expand to 5,000 widgets.

Such analysis can help establish an optimum target price that will maximize profits from a newly patented product and verify the reasonableness of cash-flow forecasts in an income-approach valuation of the patent. The analysis also may reveal some of the economic intricacies that can arise in a patent infringement case—for example, incremental lost income, lost profits due to lost revenues, and price erosion.

Profit Maximization Analysis

18. Consider the applicability of traditional valuation approaches. Traditionally, valuations are approached on cost, market and income bases. Ideally, all three approaches should be considered. However, many valuators prefer the income approach for valuing unique, income-generating properties such as patents.

A cost approach is seldom useful for patents, and the market approach may not be relevant because patents are unique by definition and comparable patents may be difficult to identify. CPA/ABVs who do use a market approach must analyze comparable patents in detail, including their legal, economic and technical differences and the respective terms of their licensing or sale.

19. Do an income-approach valuation. Variations of an income approach to valuing patents can be broadly classified as royalty-based or profit-contribution methods. “Profit contribution” refers to the profit attributable to a patent. “Royalty” refers to the income stream expected by the patent holder under a licensing transaction. Whether a profit contribution or royalty method is more appropriate in a given situation depends upon the premise of value or expected future operations—for example, whether a patent is to be sold separately or used as part of a going concern.

Other important factors relating to an income-approach appraisal of patents are

Sales projections. These can be based on a profit maximization analysis (see exhibit) or on a historical track record if it is available and predictive of future results. Penetration rates for a young patent might be due to initial product impact rather than patent rights. If that is the case, historical penetration rates might not be applicable to a discounted cash flow forecast.

Discount rate. The discount rate should properly reflect the risks of an investment in the forecasted profit stream.

To calculate the potential incremental income or profit contribution to be derived from a patent, it helps if CPA/ABVs consider the price advantage or premium associated with the sale of the patented product and/or cost savings associated with the patent’s use. Cost-savings investigations seek answers to the question: How much money would a prospective licensor save by using the patented product? Price premium investigations involve finding the price point for profit maximization (see exhibit ). Typically, a negotiated royalty rate will be lower than the projected total economic profit contribution from a patent to provide economic incentives for both licensor and licensee.

CPA/ABVs also can base their valuation on a discounted cash-flow analysis for each of two key alternatives: with a patent or without one. The discounted cash-flow analysis would factor in likely expenses, capital expenditures and working capital needs, and would utilize a discount rate consistent with the aggressiveness of the forecasted cash flows, the costs of capital and the risks of the investment. Appraisers then could value the patent as the difference between the two alternatives.

20. Write the patent valuation report. Reports should document the patents valued, assumptions made and limitations of the analysis; the procedures followed and the conclusions reached; and the qualifications of the valuation team members and their respective contributions to the appraisal. If an essential team member is missing—for example, if a patent attorney did not participate in the evaluation process—the report should disclose the possible impact of that absence as a limitation of the valuation analysis.

J. TIMOTHY CROMLEY, CPA, is an accredited senior appraiser in business valuations, a professional engineer and a registered U.S. patent attorney. He provides professional business valuation services for transactions, accounting and tax within the Valuation Advisory Services Group of JPMorgan Chase & Co. Opinions expressed herein are those of the author and do not necessarily represent the opinions of his employer or its affiliates.

评论列表

快速回复

dzx111

[6]思博省省长

主题:110 回帖:1487 积分:2944

dzx111

检查该专利的法律状态

确认价值评估的需求与背景

搜集该专利的相关信息,包括本国专利说明书、国外专利家族的清单一览、与专利有关的营运计划书、相关授权合约、相关推广与营销资料、研发成本等。

组成价值评估团队,包含专利法专家、市场专家、技术专家等。

详细阅读该专利内容

研究该专利所涵盖的技术范畴

与专利代理人讨论可专利性与专利侵权等相关信息

搜集该专利的有效性

搜集是否存在妨碍该专利实施的专利前案

考虑是否将该专利的包裹或组合以提高专利价值

搜集国外专利家族的保护范围

考虑专利的剩余寿命

分析其它专利前案是否导致应支付额外的权利金

搜集该专利的侵权诉讼威力

确认是否存在取代型技术

估计该专利的需求曲线

决定该专利所对应产品的最大价值

统整可用的财务计价模型

挑选适合的财务计价模型进行价值评估

撰写价值评估报告

2010/12/04 21:29 [来自北京市]

0 举报dzx111

ip valuation: its time, opportunity and elements

魏衍亮

【摘要】

在以知识产权资产参股时,企业需要进行知识产权评估。例如,上海天娜药物研究所开发的科技成果——“圣洁医生”消毒洗洁液,曾被评估作价2550万元。该知识产权资产入股后占新公司注册资本的51%。在北京市海淀区中关村注册成立的北京金易奥科技发展有限公司更加引人注目。一项叫做“供水系统节能优化技术”的专利技术被评估值6472万元。出资人用该项知识产权入股,占新公司注册资本的比例为99.57%。

【关键词】intellectual property, valuation

在以知识产权资产参股时,企业需要进行知识产权评估。例如,上海天娜药物研究所开发的科技成果——“圣洁医生”消毒洗洁液,曾被评估作价2550万元。该知识产权资产入股后占新公司注册资本的51%。在北京市海淀区中关村注册成立的北京金易奥科技发展有限公司更加引人注目。一项叫做“供水系统节能优化技术”的专利技术被评估值6472万元。出资人用该项知识产权入股,占新公司注册资本的比例为99.57%。

用知识产权进行质押**时,企业需要进行知识产权评估。例如,星”的文字商标曾被评估值1.08亿元。在被认定为中国驰名商标后,该文字商标的价值又被重新评估为3亿多元。凭借相关评估报告和商标权质押合同,星牌公司曾从银行获得500万元的**。

用知识产权增加注册资本数额时,企业也需要进行知识产权评估。例如,北京亿维德电气技术有限公司原来的注册资本为 400万元,知识产权出资所占的比例很低。后来,出资人陈明洋原先投入该公司的一项专利技术“基于互联网工业电气产品的供应链技术服务网络”被重新评估为 2611万元,并被完全注入总股本。这样,公司的注册资本猛增到了近3000万元,知识产权出资所占的比例超过了80%。

另外,在选择知识产权标的时,在买卖或者拒绝知识产权许可证时,在确定知识产权交易的价格时,在协商OEM或者 ODM合作契约的知识产权条款时,在遭遇侵权诉讼后分析诉讼策略和赔偿数额时,在吸引风险**、进行股份制改造、资产重组、民营化改革、企业合并、破产清算、遗产分割、奖励职务发明人时,在分享委托项目的知识产权成果、专利申请权和其他利益时,甚至在确立研发设计选题、规划知识产权检索和部署策略、开展市场布局、进行广告宣传时,企业也需要进行知识产权评估。

企业和个人如果错过知识产权评估的契机,会造成资产流失。例如,广东岭南饼干厂转让“岭南”商标时,杭州某企业转让“西湖”商标时都没有进行商标评估,没有获得任何收益。相反,浙江某企业转让其“东宝”商标时,连同其19项专利,共评估作价1000万元,获得了不菲的收益。

企业和个人如果错过知识产权评估的契机,还会造成谈判受挫。例如,我国很多企业在和国外权利人进行专利费谈判时没有出具专利稳定性报告、专利法律状态报告、专利价值报告等,这使我国企业无法压低外方的收费要价。

企业法人代表、企业直接责任人,甚至自然人如果错过知识产权评估的契机,会导致自己身陷囹圄,最高获得20年的有期徒刑。例如,广东惠州市公安机关曾处理过一件案子:三个职工盗窃了广东惠州TCL皇牌电信有限公司一台无绳电话样机。这台样机本身值680元。但是,知识产权资产评估报告显示其技术价值高达688万元。后者才是失窃物的真正价值。公安机关按照上述报告追究了当事人的刑事责任。目前很多技术秘密侵权案件发生在“跳槽”、“过失泄密”、“监守自盗”等情形下。如果侵权人事先对技术秘密的价值有所评估,尽早预期刑事惩罚的严重程度,他们就会积极规避大量的侵权行为。

知识产权评估的要素

知识产权评估需要考察的要素主要有:权利人的适格性:例如,LG、Philips曾经控告台湾华映侵犯其多项美国专利。被告检索发现,其中大多数专利实际上已经属于被告所有,于是据此反诉LG、Philips滥诉,构成不正当竞争,要求赔偿10亿美元。再例如, 1995年,北京市第一中级人民法院判决了“迪斯尼公司诉北京出版社等”案。该案中,北京出版社不知道麦克斯韦尔公司对迪斯尼的作品并不享有著作权或者分许可权,稀里糊涂出钱购买了该作品的出版发行权。后来,麦克斯韦尔公司破产了,北京出版社却要对侵犯迪斯尼公司的知识产权承担责任。我国企业还曾遇到从美国购买正版软件在中国使用,却被控侵犯中国著作权的情况。这类案件的起源都在于,买方没有分析、评估权利人的适格性。

在购买专利许可时,我国很多企业对已经被宣告无效的专利、迟缴专利费而失效的专利,甚至对已经被国家知识产权局驳回的专利申请支付了大笔费用。有些企业则对缺乏稳定性的专利支付了大笔费用。其他企业把相关专利宣告无效后,这些企业才后悔莫及。有些企业进行风险**时,向专利权人投入了很多钱。由于没有检索纸面文献,而仅仅浏览互联网专利公报,**人根本不晓得**支持的“专利”技术项目实际上已经丧失专利保护。这样的案件目前出现了不少。

2010/12/04 22:14 [来自北京市]

0 举报dzx111

evaluation of intellectual property assets, by Dr. Yanliang Wei

魏衍亮

【关键词】知识产权;评估;问题研究

一、国内外知识产权评估行业的发展

西方发达国家对知识产权评估尚未颁布专门的法律法规。****对促进知识产权的产业化、商业化有较多的立法尝试,但是对于知识产权的价值评估也未颁布法规。在法律、商业实践中,国外的知识产权评估主要有两种:第一种,当事人针对特定的法律、商业项目进行的博弈性知识产权价值评估。在这种评估中,当事人各方都会对知识产权的价值出具评估报告,通过谈判、争论,共同确定知识产权的价值。这种评估主要依靠对技术的检索、分析、评估报告,工作团队主要来自企业内部熟悉相关技术和市场的资深人士,专业评估机构主要提供辅助性的检索、分析、流程控制、模式设计等服务。第二种,专业评估机构为政府、银行、**公司、**会等提供的参考性知识产权价值评估。这种评估的报告主要用于抵押**、税收减免、捐助等特定的项目,工作团队主要来自专业评估机构,其评估报告倾向于压低知识产权的价值,帮助报告获取方获得有力的谈判地位。这类报告的水平一般比较低。例如,美国某些著名的专利价值评估公司聘用的高级专利分析师甚至没有任何理工科技术背景。在某些重要的商业项目中,这类公司出具的一些技术分析报告的核心结论已经被证明是完全错误的。尽管如此,由于特定需求的日益增长,第二类评估尚有较大的发展空间。

总体上看,包括新设公司知识产权出资、公司并购、侵权赔偿、许可贸易等大部分知识产权评估在内,发达国家,尤其美国的评估工作主要依靠利益相关人的谈判与争论,其评估手段也五花八门。西方尚未出现由专业评估机构垄断相关市场,甚至形成统一的评估规范、模式、方法、流程的趋势。相反,这恰恰是我国的趋势。

我国政府、行业协会已经对知识产权的价值评估形成一套复杂的规范性文件。例如,国务院、财政部等主管部门已经颁发了《国有资产评估管理办法》、《国有资产评估管理若干问题的规定》、《国有资产评估违法行为处罚办法》、《关于加强和规范评估行业管理的意见》、《资产评估机构审批管理办法》、《资产评估准则——基本准则》、《资产评估职业道德准则——基本准则》、《资产评估准则——无形资产》等规范性法律文件。半官方的中国资产评估协会也发布了《企业价值评估指导意见(试行)》、《注册资产评估师关注评估对象法律权属指导意见》等执业准则。随着法规的逐步完善,我国无形资产评估行业取得了较大的发展。目前,我国已有专业的无形资产评估事务所十多家。此外,近3800多家综合性的评估事务所也在从事无形资产的评估工作,从业人员达6万多人,其中注册评估师2万多人。从业务实践看,主要是企业为获取行政登记、资质、许可、证明等单方申请的小型评估,一般不涉及技术分析,层次较浅,难度和用途都不大,纯商业性的知识产权评估尚极为罕见。

2005年,国务院启动了国家知识产权战略的制定、实施工作。2006年,***等中央领导纷纷指示,要加强知识产权的产业化、商品化工作。响应中央号召,我国颁布了新公司法。删除了知识产权出资比例的旧规定——“以工业产权、非专利技术作价出资的金额不得超过有限责任公司注册资本的20%。”新法允许知识产权出资比例占到注册资本的70%。一些开发区的管理实践更进一步,知识产权出资比例已经没有任何限制。新的法律和实践提高了知识产权资产的重要性,为知识产权资产评估行业的大发展创造了基础条件。

更重要的是,2006年4月,财政部和国家知识产权局联合颁发了《关于加强知识产权资产评估管理工作若干问题的通知》。该文件规定知识产权占有单位符合下列情形之一的,应当进行资产评估:根据《公司法》第二十七条规定,以知识产权资产作价出资成立有限责任公司或股份有限公司的;以知识产权质押,市场没有参照价格,质权人要求评估的;行政单位拍卖、转让、置换知识产权的;国有事业单位改制、合并、分立、清算、**、转让、置换、拍卖涉及知识产权的;国有企业改制、上市、合并、分立、清算、**、转让、置换、拍卖、偿还债务涉及知识产权的;国有企业收购或通过置换取得非国有单位的知识产权,或接受非国有单位以知识产权出资的;国有企业以知识产权许可外国公司、企业、其他经济组织或个人使用,市场没有参照价格的;确定涉及知识产权诉讼价值,人民法院、仲裁机关或当事人要求评估的;法律、行政法规规定的其他需要进行资产评估的事项。此外,该通知规定,非国有单位发生合并、分立、清算、**、转让、置换、偿还债务等经济行为涉及知识产权的,可以参照国有企业进行资产评估。

《通知》还规定,知识产权评估应当依法委托经财政部门批准设立的资产评估机构进行评估。资产评估机构在执行知识产权评估业务时,可以聘请专利、商标、版权等知识产权方面的专家协助工作,但不能因此减轻或免除资产评估机构及注册资产评估师应当承担的法律责任。为了加强对知识产权评估行业的管理,《通知》规定,财政部和国家知识产权局共同组织知识产权评估专业培训、考核并颁发培训证书,建立并严格执行继续教育、培训考核制度,确保培训的质量,不断提高注册资产评估师及从业人员知识产权评估的专业能力和水平。

上述《通知》可望大大促进我国知识产权评估行业的发展。

二、知识产权评估的契机与要素

(一)知识产权评估需求的日益增长

随着我国经济的快速发展,我国已成为全球重要的知识产权买入国。例如,2005年,我国共登记技术进口合同9902 份,同比增长15.1%;合同进口金额190.5亿美元,同比增长37.5%;其中技术使用费118.3亿美元,占合同总金额的62.1%。从统计数据看,2000年以来,工业产权许可费用约占我国技术引进总费用的60%到80%。除了工业产权,我国进口的其他知识产权数量也不少。例如,2003年以来,我国每年买入版权上万项。有些版权进口项目耗资十多亿美元,例如,2006年,我国政府通过外交承诺和行政命令向美国微软公司采购了十多亿美元的计算机软件。从目前的趋势看,我国知识产权贸易将继续快速增长,知识产权评估服务市场可望继续快速成长。

(二)知识产权评估的契机

从国内外商业、法律实践看,知识产权评估主要发生在如下场合:第一,知识产权贸易需要企业进行知识产权价值评估。目前,技术贸易额已接近全球贸易总量的1/2,而且大宗知识产权交易层出不穷。例如,1995年 11月,美国IBM耗资35亿多美元收购了软件公司莲花,当时莲花公司账面和实体资产都不过5000万美元。该交易中,绝大部分收购费用用于购买莲花软件的知识产权。2006年1月,瑞典爱立信正式收购英国电信公司马可尼,交易价格约21亿美元,约为马可尼公司市值的两倍。该笔收购支出中,约90%用于购买马可尼公司的无形资产——主要是知识产权。第二,在以知识产权资产参股时,企业需要进行知识产权评估。例如,上海天娜药物研究所开发的科技成果——“圣洁医生”消毒洗洁液,曾被评估作价2550万元。该知识产权资产入股后占新公司注册资本的51%。在北京市海淀区中关村注册成立的北京金易奥科技发展有限公司更加引人注目。一项叫做“供水系统节能优化技术”的专利技术被评估值6472万元。出资人用该项知识产权入股,占新公司注册资本的比例为 99.57%。第三,用知识产权进行质押**时,企业需要进行知识产权评估。例如,星”的文字商标曾被评估值1.08亿元。在被认定为中国驰名商标后,该文字商标的价值又被重新评估为3亿多元。凭借相关评估报告和商标权质押合同,星牌公司曾从银行获得500万元的**。第四,用知识产权增加注册资本数额时,企业也需要进行知识产权评估。例如,北京亿维德电气技术有限公司原来的注册资本为400万元,知识产权出资所占的比例很低。后来,出资人陈明洋原先投入该公司的一项专利技术“基于互联网工业电气产品的供应链技术服务网络”被重新评估为2611万元,并被完全注入总股本。这样,公司的注册资本猛增到了近3000万元,知识产权出资所占的比例超过了80%。第五,确定法律诉讼赔偿金数额时也需要知识产权价值评估。例如, 2005年,美国医疗公司Medtronic在侵权诉讼中屈服,同意向原告支付13.5亿美元的知识产权使用费。同年,微软公司也与Sun公司结束法律诉讼,同意向后者支付知识产权许可与反垄断费用19.5亿美元。

另外,在选择知识产权标的时,在协商OEM或者ODM合作契约的知识产权条款时,在遭遇侵权诉讼后分析诉讼策略时,在吸引风险**、进行股份制改造、资产重组、民营化改革、企业合并、破产清算、遗产分割、奖励职务发明人时,在分享委托项目的知识产权成果、专利申请权和其他利益时,甚至在确立研发设计选题、规划知识产权检索和部署策略、开展市场布局、进行广告宣传时,企业也需要进行知识产权评估。

企业和个人如果错过知识产权评估的契机,会造成资产流失。例如,广东岭南饼干厂转让“岭南”商标时,杭州某企业转让“西湖”商标时都没有进行商标评估,没有获得任何收益。相反,浙江某企业转让其“东宝”商标时,连同其19项专利,共评估作价1000万元,获得了不菲的收益。

企业和个人如果错过知识产权评估的契机,还会造成谈判受挫。例如,我国很多企业在和国外权利人进行专利费谈判时没有出具专利稳定性报告、专利法律状态报告、专利价值报告等,这使我国企业无法压低外方的收费要价。

企业法人代表、企业直接责任人,甚至自然人如果错过知识产权评估的契机,会导致自己身陷囹圄,最高获得20年的有期徒刑。例如,广东惠州市公安机关曾处理过一件案子:三个职工盗窃了广东惠州TCL皇牌电信有限公司一台无绳电话样机。这台样机本身值680元。但是,知识产权资产评估报告显示其技术价值高达688万元。后者才是失窃物的真正价值。公安机关按照上述报告追究了当事人的刑事责任。目前很多技术秘密侵权案件发生在“跳槽”、“过失泄密”、“监守自盗”等情形下。如果侵权人事先对技术秘密的价值有所评估,尽早预期刑事惩罚的严重程度,他们就会积极规避大量的侵权行为。

(三)知识产权评估的要素

知识产权评估需要考察的要素主要有:权利人的适格性:例如,LG、Philips曾经控告台湾华映侵犯其多项美国专利。被告检索发现,其中大多数专利实际上已经属于被告所有,于是据此反诉LG、Philips滥诉,构成不正当竞争,要求赔偿10亿美元。再例如,1995年,北京市第一中级人民法院判决了 “迪斯尼公司诉北京出版社等”案。该案中,北京出版社不知道麦克斯韦尔公司对迪斯尼的作品并不享有著作权或者分许可权,稀里糊涂出钱购买了该作品的出版发行权。后来,麦克斯韦尔公司破产了,北京出版社却要对侵犯迪斯尼公司的知识产权承担责任。我国企业还曾遇到从美国购买正版软件在中国使用,却被控侵犯中国著作权的情况。这类案件的起源都在于,买方没有分析、评估权利人的适格性。

在购买专利许可时,我国很多企业对已经被宣告无效的专利、迟缴专利费而失效的专利,甚至对已经被国家知识产权局驳回的专利申请支付了大笔费用。有些企业则对缺乏稳定性的专利支付了大笔费用。其他企业把相关专利宣告无效后,这些企业才后悔莫及。有些企业进行风险**时,向专利权人投入了很多钱。由于没有检索纸面文献,而仅仅浏览互联网专利公报,**人根本不晓得**支持的“专利”技术项目实际上已经丧失专利保护。这样的案件目前出现了不少。

此外,当事人还要搜集和评估知识产权的正面和负面权利证据,评估市场上现存的多个许可证的重叠性,寻找和评估用于交叉许可的知识产权筹码、竞争性技术路线、互补性技术路线,评估前引技术、后引技术、平行技术,评估许可对象的研发成本、权利的法律状态、权利的稳定性、权利延续的时间、知识产权垄断的产品和服务市场的寿命、市场收益递增与衰减规律等。他们还要评估知识产权的实施成本、知识产权许可的类型和地域、第三方的模仿能力、所在国的立法和执法水平、许可费的支付方式、知识产权侵权追究权与追究费用的配置、改进技术的专利申请权配置、有无附属的技术秘密、技术诀窍掌控专家的劳务合同与身体健康状况、技术诀窍的文本语言、知识产权的交易成本、技术的革新速率、有无许可证平等条款和最优惠担保条款等。当然,知识产权所处的申请、异议、无效、续展程序,以及法律修改后的权利稳定性等都在评估之列。

在商业、法律实践中,知识产权评估的核心要素,即撰写知识产权评估报告的重点在于开展专利、非专利技术的深度检索、分析、评估。这个工作主要涉及三个方面的内容:第一,找全、找准相关文献;第二,分析专利的权利要求保护范围和专利的稳定性,分析专有技术的保护范围和权利的稳定性;第三,分析技术独占权在目标市场所覆盖的技术、产品、产业领域,分析维护该独占权的成本,以及上述覆盖的时间期限和可能取得的收益。

总之,知识产权评估报告涉及哪些要素,这要就事论事,根据具体案情和意图进行选择。评估报告的内容哪些公开,哪些需要陆续地秘密提供给对方,哪些需要由第三人不经意地“泄漏”给对方,这都要根据具体情况进行部署或应对。知识产权评估报告的制作、修改、发布过程本身维系了大量的商业竞争、谈判活动。一般情况下,知识产权的交易价格取决于当事人的互动过程、商业运作,任何评估报告仅仅是互动、运作的工具之一。有理、有力的评估报告主要用于说服谈判对象,未必能真实地反映知识产权的价值。对于知识产权的价值,也许仅仅存在主观事实,而未必存在什么客观事实。

尽管如此,各国专业机构的知识产权评估业务仍将快速增加。随着市场化程度的提高,北京东方灵盾公司、北京产联科技发展中心等掌握强大专利检索、分析力量的私营机构可望成为我国权威的知识产权评估机构。缺乏专利检索、分析能力的服务机构将被迫退出市场。

2010/12/05 07:43 [来自北京市]

0 举报dzx111

上面段落文字中,點出「沒打過仗,就不會有優質專利」重要內涵。

首先,訴訟的場域(戰場)是檢視專利品質之重要場所。優良的訴訟場域(以本例來說是美國)能檢驗出爭議專利品質,較差的訴訟場域(以本例來說是台灣)不易檢驗出爭議專利品質。而各國訴訟場域之好壞,與該國智慧財產權權利化制度與保護制度息息相關。

其次,優良訴訟場域的訴訟經驗與回饋(知識學習與經驗累積),可以促使企業強化能夠上戰場專利之布局。也就是說,透過讓專利上戰場(暴露在外部攻擊下),可以讓企業修正與重建本身技術品質與專利品質。其中,技術品質即是研發程序嚴謹度,專利品質即是技術權利化過程品質。

第三,透過專利侵權訴訟程序,可檢視爭議案件專利代理人(專利訴訟律師)與鑑定人(技術專家)專業水平、專業倫理、專業信用與信賴關係,也就是專利訴訟代理人等之專業品質。

換言之,專利訴訟場域即是專利價值好壞之重要檢驗場所,如同生產流程中的品質檢驗般,必須通過:技術品質、.專利化品質、專利訴訟品質,這三項重要檢驗內容。

從另一角度來看,若「沒打過仗,就不會有優質專利」,那「身經百戰專利,必是高價值專利」,也就是隨著外部品質稽核程度加劇,能夠生存下來的專利都是具有價值之專利。基於此,我們可計算出專利產業面價值評估公式,如圖一。

圖一、專利產業面價值評估公式

專利產業面價值 = (包括專利技術面品質) X (技術權利化流程品質) X (商業化流程品質之訴訟品質)

要有高的專利價值,技術面品質、權利化流程品質與訴訟品質缺一不可,一旦,其中一項為零,因為是相乘關係,整個專利價值即變成零。需要強調,上面三項品質應負責者不同,技術品質控管主要是研發人員之責任;權利化流程品質控管者為企業內部專利工程師與外部專利事務所之專利工程師;而專利訴訟品質控管即是進行專利訴訟之專利律師的責任。當然,歸咎到最後,就是企業最高階層經營者(或老闆)之責任。

最後,台灣廠商透過美國專利訴訟經驗(自己經驗,別人經驗),逐漸累積與建立企業本身專利的生命週期品質管理(Patent Lifecycle Quality Management)機制是重要的。不然書到用時方恨少,等到企業要上專利戰場時,才赫然發現手頭專利一堆,但是可用的沒半個之遺憾。(1201字;圖1)

關鍵字:專利訴訟;專利生命週期品質管理(Patent Lifecycle Quality Management);專利布局; 專利產業面價值評估

(科技產業資訊室-- David 編撰,2008/06/24)

2010/12/05 07:45 [来自北京市]

0 举报dzx111

2010/12/05 07:47 [来自北京市]

0 举报dzx111

2010/12/05 07:48 [来自北京市]

0 举报